Staying up to date on financial aid can help alleviate the financial burden and increasing costs of attending college.

To start, students can complete the Free Application for Federal Student Aid. Factors like expected family contribution affect how much aid a student will likely receive.

According to Jacob Rester, financial aid counselor, one of the most common financial aid question is how much aid a student can receive each cycle.

“The answer depends on many things such as the student’s EFC on their FAFSA, if they qualify for TOPS or scholarships and other factors,” explained Rester. “If a student or prospective student wants to know how much aid to expect and what expenses they’ll have, they should feel free to contact the financial aid office.”

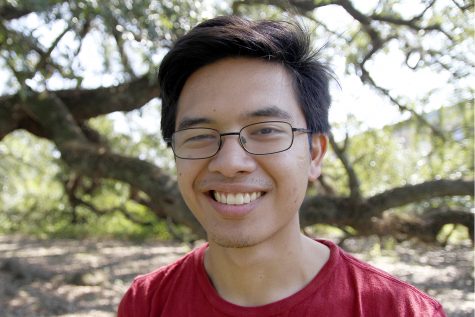

For Collin Waltz, a sophomore accounting major, his largest concern was where to send money to pay off loans before finishing school.

Waltz said, “I asked a lot of questions to a lot of different departments, and they never lacked to give me answers, but they always provided me with the right answers and the right people to go ask those questions to, and I never really had a problem.”

Students may need to distinguish between subsidized and unsubsidized loans in their aid.

“Subsidized loans are always a better deal in short,” shared Rester. “The longer answer is subsidized loans are interest-free as the federal government covers the interest while the student is enrolled at least half time. Unsubsidized loans are not interest-free. Not all students qualify for subsidized loans, though, as it depends on the student’s EFC on their FAFSA. If the EFC is too high, then the student would only be eligible for unsubsidized loans, starting at $5,500 a year for a freshman.”

Though international students may face different qualifications or available aid, they are also encouraged to apply for financial aid.

“In order to receive federal aid, an international student must be considered an eligible non-citizen,” stated Rester. “They would not be eligible for TOPS but could qualify for scholarships.”

Misconceptions can make the financial aid process confusing. The best way to know the facts is to contact the appropriate professional.

“One we commonly hear are students comparing their aid to a friend’s and trying to find out why a difference exists,” said Rester. “The answer to that is each student’s aid is unique and depends on many factors.”

Students can manage their aid by checking the to-do list or the “Campus Finances” tab on LeoNet for any necessary documents or amount of aid received.

“It’s recommended the student continue to check their account until the aid is posted as sometimes students turn in incomplete or unsigned documents,” explained Rester. “Should students have any additional questions about their aid, FASFA or checklist items, feel free contact our office.”

Waltz discussed the importance of financial aid for students.

“College is a very hard place,” shared Waltz. “It can get very hard, and it can slip through your hands very quickly, so right when you get into college, you should ask as many questions as you possibly can to get any information you need answered, answered immediately before it affects you in the academic standing.”

Any additional questions can be addressed to the Office of Financial Aid, located on North Campus, by calling 985-549-2244 or going to the office. Students or parents can also check the website for the U.S. Department of Education’s Office of Federal Student Aid for help getting started.