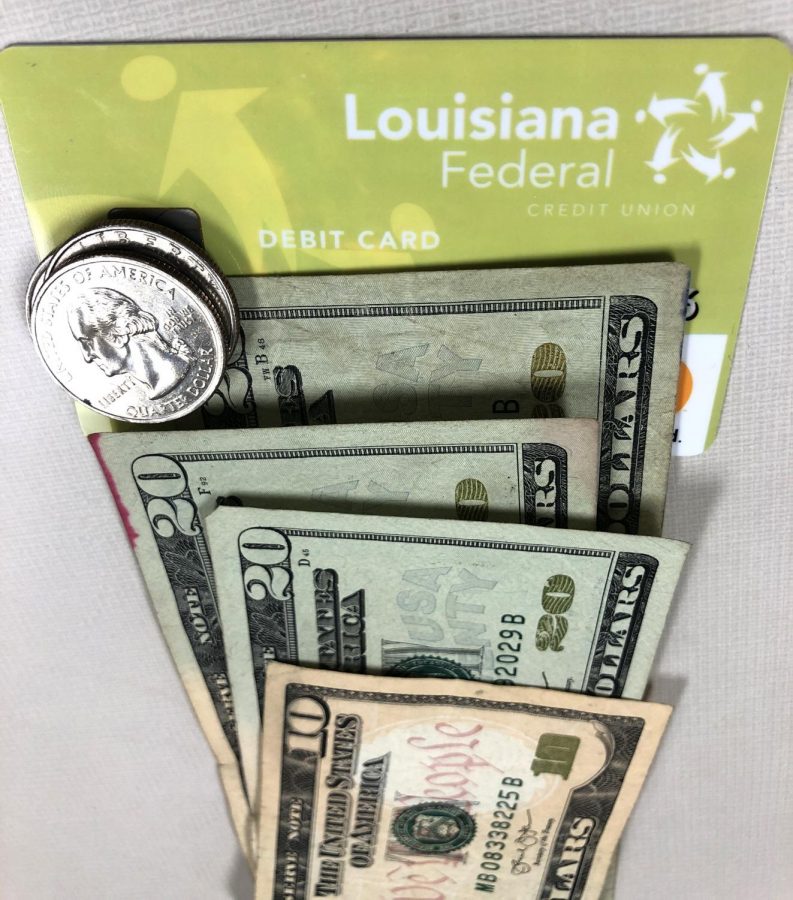

Establishing and building credit: why and how?

Learning about credit and how it impacts the future can be an important life skill for students to learn while in college.

The transactions students make to finance their education builds up a personal credit history.

Rakesh Duggal, professor of finance, reasoned why he thinks it is important for students to build credit.

“Most individuals borrow money to finance their education, or buy houses, cars etc.,” said Duggal. “Also, most small business owners borrow funds to run/grow their businesses, and banks often use their personal credit history for lending decisions.”

Many banks reach out to to students in their region to help them learn about good credit habits.

Chase Bank offers information on their website for students wanting to gather more information. Regions Bank in Hammond also provides information through their website on how students can benefit from learning more about establishing and building credit. According to their website, “the Regions Next Step Financial Learning Center offers a self-paced series of interactive videos covering financial wellness tips and action plans designed to help you make the best choices for you and your family.”

Dr. Lou Le Guyader, associate professor of accounting, believes that parents are the first stepping stone to learning about establishing credit.

“I believe that parents should be the first contact with lessons about that,” shared Guyader. “First of all, until you reach a certain age, your parents are responsible for you. Secondly, you are more likely to trust them, and thirdly, they are going to be more objective and caring about approaching credit with certain degree of conservatism so you do not take out too much money. “

Guyader also explained the fundamental first step that is important for students to start their credit journey.

“The first thing to understand is having income to be able to start off your credit,” said Guyader. “The second thing is that it is one thing to have credit, but the most important thing is to pay your credit on time and in full and by doing this will enhance your credit.”

Guyader believes that establishing credit early has a positive affect for the near future when looking to buy expenses like a car or a house.

“In the long term you will probably need credit to buy your own home or your own car and a mortgage on a home or an auto loan on a car will require an appropriate amount of credit,” reasoned Guyader. “The cost or this mortgage or auto loan will be less costly if the credit standing is higher. “

Duggal believes that even though there are positives to credit, there can also be negative aspects.

“If students pay bills late or not pay at all, this can result in negative consequences of having credit,” said Duggal.

Students can reach out to local banks and inquire about credit to help them understand how it will impact them in the future.

Your donation will support The Lion's Roar student journalists at Southeastern Louisiana University.

In addition, your contribution will allow us to cover our annual website hosting costs.

No gift is too small.